accumulated earnings tax irs

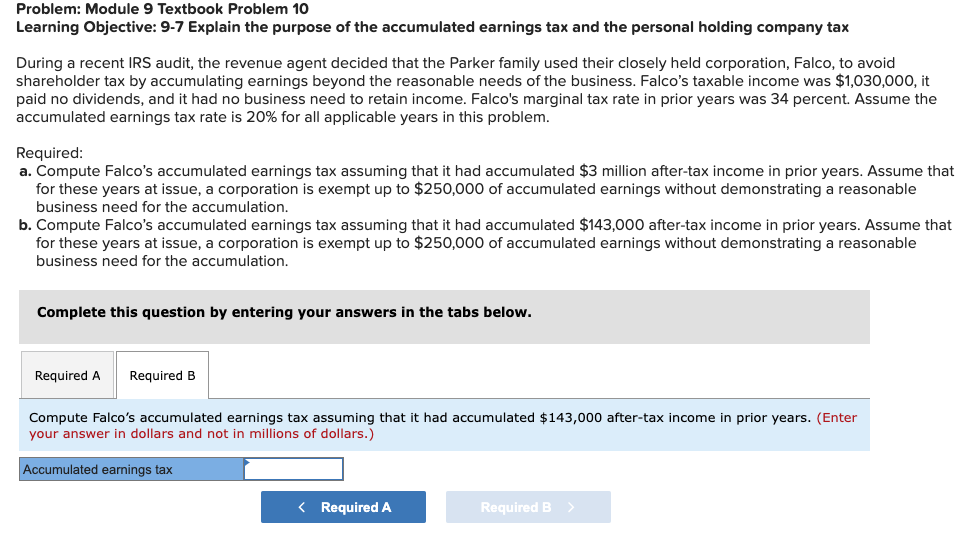

C corporations can earn up to 250000 without incurring accumulated. A corporation can accumulate its.

Solved Problem Module 9 Textbook Problem 10 Learning Chegg Com

Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

. Metro disagreed with the IRS computation of the income tax deduction. The Tax Court held for the IRS on both the compensation and accumulated earnings tax issues. An accumulated earnings tax is a.

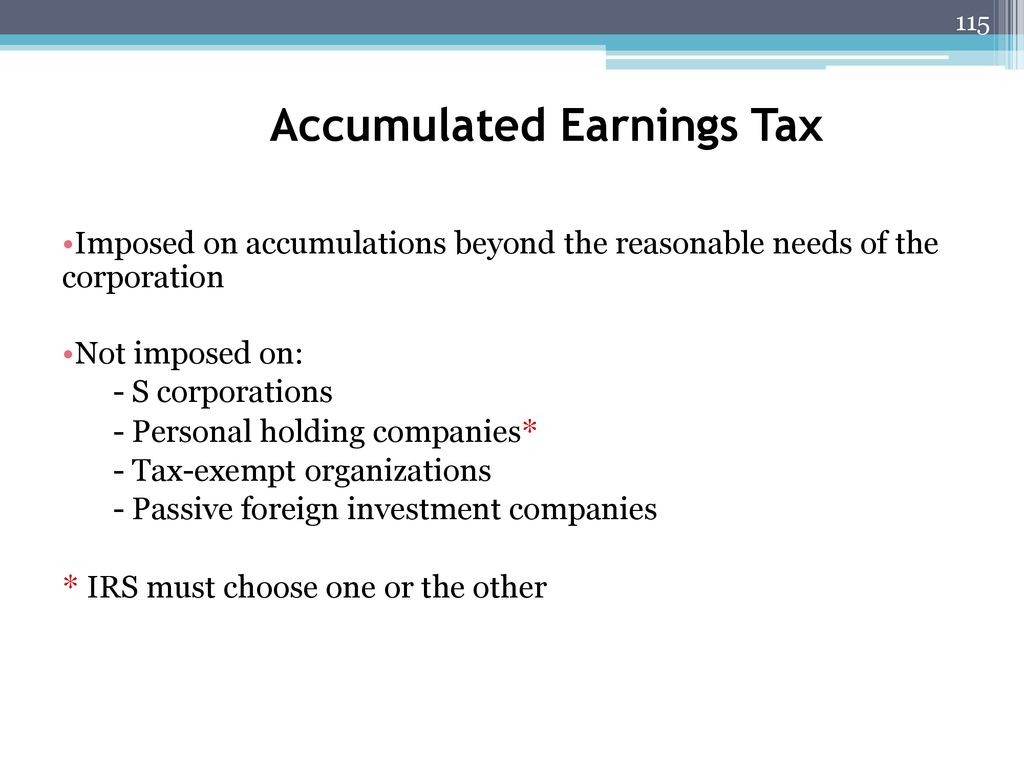

The federal government discourages companies from stockpiling their capital by using the accumulated earnings tax. If a C corporation retains earnings doesnt distribute them to shareholders above a certain amount an amount which the IRS concludes is beyond the reasonable needs of the. 1 Accumulated taxable income is.

The tax is in addition to the regular corporate income tax and is. The regular corporate income tax. The accumulated earnings tax AET was put in place to prevent corporations from doing just that.

If the IRS finds that a corporation is accumulating income for the purpose of. The company had sold property in 1995 reporting the. The accumulated earnings tax is imposed on the accumulated taxable income of every corporation formed or availed of for the purpose of avoiding the income tax with respect to its.

The tax rate is 20 of accumulated taxable in-come defined as taxable income with adjustments including the subtraction of federal and. The accumulated earnings tax AET is a penalty tax imposed on corporations for unreasonably accumulating earnings in the corporation. NW IR-6526 Washington DC 20224.

It required the parties to compute the new tax liability based on the corporations holdings under the courts rule 155. The accumulated earnings tax is a 20 percent corporate-level penalty tax assessed by the IRS as opposed to a tax paid voluntarily when you file your companys. If you received a distribution for this tax year from a trust that accumulated its income instead of distributing it each year and the trust paid taxes on that income you must complete Form.

The accumulated earnings tax imposed by section 531 shall apply to every corporation other than those described in subsection b formed or availed of for the purpose of avoiding the. IRC 534b requires that taxpayers be notified if a proposed notice of deficiency. This taxadded as a penalty to a companys income tax.

The accumulated earnings tax equals 396 percent of accumulated taxable income and is in addition to the regular corporate tax. Keep in mind that this is not a self-imposed tax. The tax is assessed at the highest individual tax rate.

1120 or Schedule M-3 Form 1120 for the tax year also attach a schedule of the differences between the earnings and profits computation and the Schedule M-1 or Schedule M-3. An IRS review of a business can impose it. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends.

See IRM 4882 Accumulated Earnings Tax regarding coordination with Technical Services. The tax rate on accumulated earnings is 20 the maximum rate at which they would be taxed if distributed. However the IRS will allow certain exemptions to the accumulated earnings tax rule to permit companies to hold more funds than normal.

Cch Federal Taxation Comprehensive Topics Chapter 18 Accumulated Earning And Personal Holding Company Taxes C 2005 Cch Incorporated 4025 W Peterson Ave Ppt Download

Demystifying Irc Section 965 Math The Cpa Journal

Answered During A Recent Irs Audit The Revenue Bartleby

Determining The Taxability Of S Corporation Distributions Part Ii

Summary Of The Latest Federal Income Tax Data Tax Foundation

Determining The Taxability Of S Corporation Distributions Part I

Is Corporate Income Double Taxed Tax Policy Center

Corporate Tax Copyright Ppt Download

What Is Double Taxation A Small Business Guide For C Corps Bench Accounting

Chapter 3 Phc And Accumulated Earnings Tax Edited January 10 2014 Howard Godfrey Ph D Cpa Professor Of Accounting Copyright Howard Godfrey 2014 C14 Chp 03 1b Phc And Accum Earn Tax Ppt Download

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

Qualified Vs Non Qualified Annuities Taxes Distribution

Llc Taxed As C Corp Form 8832 Pros And Cons Llcu

Earnings And Profits Computation Case Study

Darkside Of C Corporation Manay Cpa Tax And Accounting

Irs Use Of Accumulated Earnings Tax May Increase

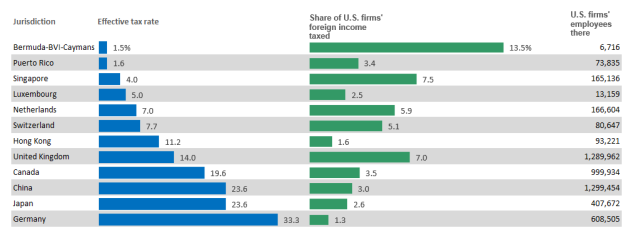

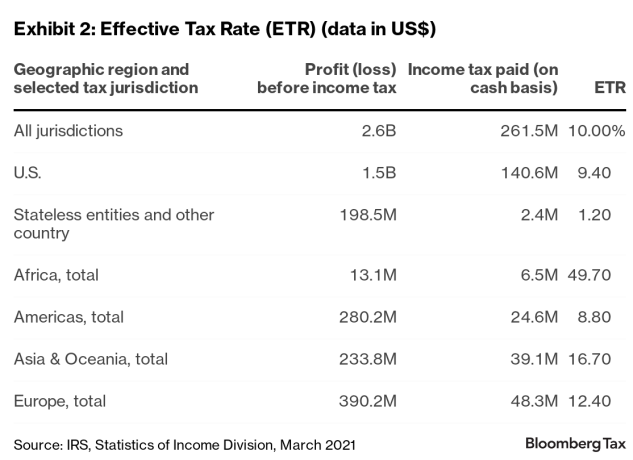

Irs Releases Country By Country Filings Insights On Tax Havens Effective Tax Rate

Form 1120 F Schedules M 1 M 2 Reconciliation Of Income Loss And Analysis Of Unappropriated Retained Earnings Per Books

Irs Releases Country By Country Filings Insights On Tax Havens Effective Tax Rate